Deciding Between the Old and New Tax Regime: Who Should Pick What?

Deciding Between the Old and New Tax Regime Who Should Pick What

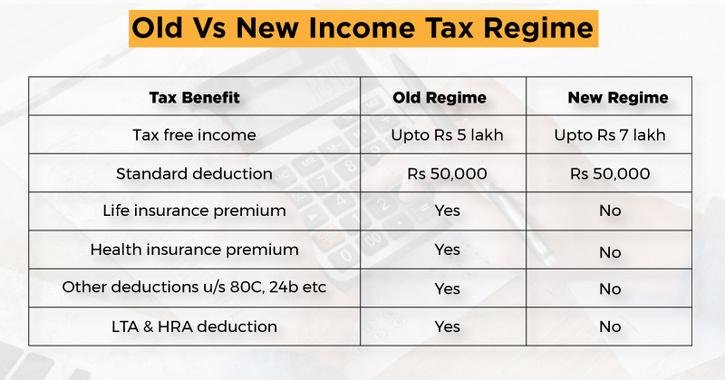

The updated income tax slabs, which were revealed in the Union Budget 2023, have reduced the imbalance for salaried persons, elderly people, and retirees between the former tax system and the new income tax slabs.

The break-even point in this new modification is the maximum deduction required under the prior tax code that must be met for the amount of income tax due under both systems to be equal. Let’s examine the updated new tax system for 2023.

A Brief Guide to the New Income Tax Regime

The Government unveiled a new personal income tax system for individual taxpayers earlier this year. People can choose between the previous tax system and the updated new one. By selecting the previous tax system, the taxpayer can keep making use of current tax benefits/deductions such as deductions on home loan principal and interest, life insurance premium deductions, health insurance premium deductions, LTC cash vouchers, and other benefits under Sections 80C and 80D of the Income Tax Act.

Although the new updated tax regime has lower tax rates than the old regime, choosing the new regime will require the taxpayer to sacrifice the majority of tax exemptions and deductions that are offered under the old regime.

In this article, we have clarified a few key questions regarding the updated new tax system.

What are the tax rates and income tax slabs as per the revised new tax regime?

The updated income tax rates under the new tax law for the fiscal years 2023–24 (AY 2024-25) are presented in the table below.

| Income tax slab | Income tax rate |

| INR 3,00,000 | Nil |

| INR 3,00,000 to INR 6,00,000 | 5% |

| INR 6,00,000 to INR 9,00,000 | 10% |

| INR 9,00,000 to INR 12,00,000 | 15% |

| INR 12,00,000 to INR 15,00,000 | 20% |

| Income above 15,00,000 | 30% |

There are two key things worth noting here. First, the Government has proposed an increase in the income tax rebate limit to Rs. 7 lakh from Rs. 5 lakh earlier in the new tax regime. It has also allowed a standard deduction of Rs. 50,000 in the same.

Now that we know how the new income tax regime works let us see who should choose the new income tax regime and who should choose the old income tax regime.

Making a Choice Between the Old and New Tax Regime

Suppose the maximum deductions and exemptions claimed by income earners are more than Rs. 4.25 lakh for an income beyond Rs. 15.5 lakh. In that case, the individual may reduce their tax liability as per the old tax regime from April 1, 2023, as per several reports. Moreover, a salaried individual immediately qualifies for a “standard deduction” of INR 50,000 as part of the exemptions and deductions. They do not need to submit any papers to claim the standard deduction.

The current break-even income is Rs. 7.5 lakhs. In the previous tax system, a person with an income of Rs. 7.5 lakh might reduce their taxable income to Rs. 5 lakhs by claiming the maximum permitted deductions and exemptions of Rs. 2.5 lakh. An individual is now eligible for reimbursement under “Section 87A” of the prior tax law because he no longer owes any taxes. If the same individual selects the revised new tax system, they will be eligible for a “Section 87A” refund (for income up to Rs. 7 lakhs), a tax deduction of INR. 50,000, and would not owe any taxes.

Similarly, suppose a person with a gross income of Rs. 10 lakh chooses to claim exemptions and deductions such as “Section 80C, 80D, 80TTA, HRA exemption, and LTA exemption” for a maximum of Rs. 3 lakhs. In that case, they become tax neutral in both tax systems. The new tax system will be advantageous in several aspects for a salaried taxpayer whose claimed deductions are less than Rs. 3 lakhs.

For salaried persons with incomes below Rs.12.5 lakh, the amount of tax due will remain identical under the new income tax slabs and the old tax system if opted for. Individuals who are eligible for deductions (Section 80C, 80D, 80E, 80TTA, etc.), tax exemptions on HRA, LTA, and standard deductions of Rs.50,000 can account for a maximum total of Rs.3,62,500. It is preferable to choose the revised tax system if the amount of the deduction sought is less than Rs 3,62,000.

To benefit from the old tax system, a salaried person with a total salary of Rs. 15 lakhs must deduct more than Rs. 4,08,332 in expenses. For the old tax system to be advantageous, the deductions must total more than Rs. 4,25,000 if the individual has a yearly income of Rs. 20 lakhs.

Conclusion

In conclusion, the total number of deductions and exemptions that each person receives under the old tax system determines whether they should choose the old or new tax system. Simply put, you would be better off sticking to the previous tax system if the total amount of exemptions and deductions you are qualified to claim under it exceeds the break-even level corresponding to your income level. Otherwise, switching to the revised tax system is advantageous for several people. Yet, advantages like life insurance tax benefits (the deductions) will be absent in the new regime, and it can pose a problem with a rise in income down the line, as per several experts. Hence, choose wisely.