Step-by-Step Guide to Opening a Demat Account and Using an Online Trading App for Smart Investing

Opening A Demat Account

A demat account combined with a robust and feature-rich trading app makes the investment process convenient. Investing in stock market securities becomes easy and hassle-free. However, beginner investors may find opening a demat account and using a trading app difficult. Here is a step-by-step guide on how to open a demat account and use a trading app from scratch:

What is a demat account and trading application?

A demat account serves as an online locker that stores various securities like shares, bonds, debentures, and other stock market securities. Shares and securities in dematerialized format can be stored, bought, and sold using a demat account. A trading app on the other hand helps with buying and selling securities like stocks, ETFs, mutual funds, etc. Users can open demat account, place a trade on a trading app, and start their investment journey.

How to open a demat account?

1. Selection of a reliable Depository Participant:

A depository participant or DP acts as an intermediary between Depositories and Investors. Regulated by SEBI, the depository participant helps in buying and selling securities, ensures their safekeeping, and keeps investor’s financial information protected from unwanted access. Banks, financial institutions, and even private companies can act as depository participants only after completing the necessary prerequisites from SEBI. Investors have to select a depository participant through analysis of aspects like Maintenance charges, and the level of trading application and their features.

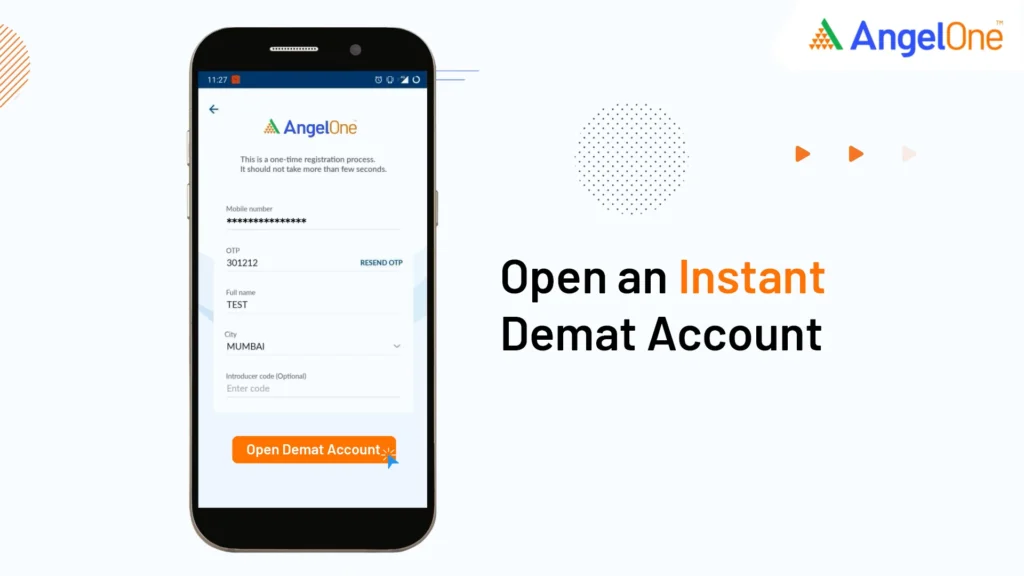

2. Initiate the process of opening of a demat account:

Investors must visit the official website of a depository participant offering demat account services. Various details like name, personal email ID, phone number and date of birth have to be provided to sign up for a demat account. KYC documents like PAN card, Adhaar card, and Bank account details have to be provided as well. Some DPs opt for online and even offline user verification processes to verify the identity of the investor. After completion of all the necessary steps, investors receive an email confirming the opening of their demat account.

How to use a trading app?

1. Users have to download an online trading app that helps place buy and sell orders for securities like shares, debentures, ETFs, etc. After selection, the app must be downloaded on smart devices for use.

2. Users then have to open their trading app, input login credentials and Link their Trading account with their demat account.

3. A PIN or password has to be used to secure the application from unwanted use.

4. Users have to link their Trading app with their official and corresponding bank account to transfer funds easily and securely. The required funds must be deposited into the trading app to buy securities. UPI, Net Banking, and other options are available on the trading app to pay for buying securities.

5. Investors after downloading their trading app, linking it with a demat account, and depositing necessary funds must select the securities they wish to invest in. Shares, ETFs, commodities, Mutual funds, and various other types of securities are available that Investors can select based on their preferences and investment goals.

Conclusion

Investors can easily start investing in stock market-listed securities by opening a demat account and downloading a trading app. After all the verifications and approvals, Investors can buy and sell securities and even manage their investment portfolio to generate profits and for long-term wealth generation.