Peter Schiff Says Investing in the Magnificent 7 a Decade Ago Would’ve Made Him “A Lot Richer”

Peter Schiff Says Investing in the Magnificent 7 a Decade Ago Would’ve Made Him “A Lot Richer”

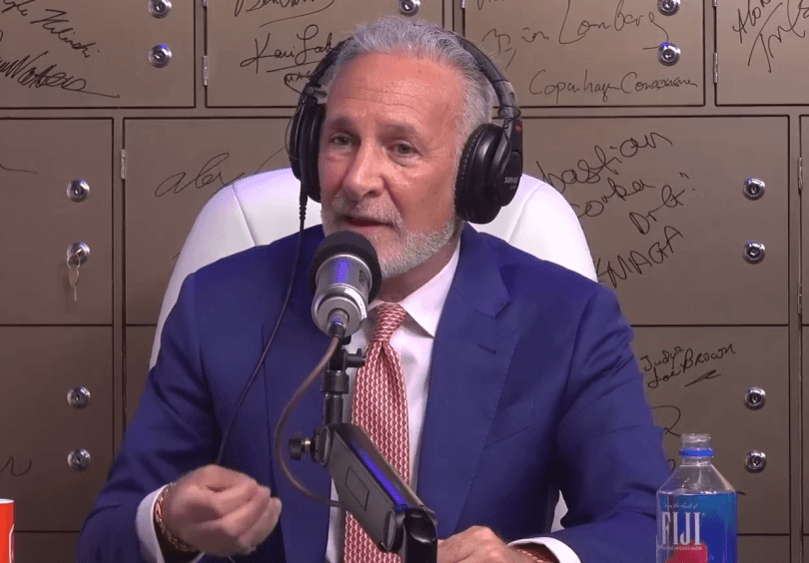

Longtime gold advocate and economist Peter Schiff says he left significant money on the table over the past decade by favoring precious metals over high-growth tech stocks.

In a 2024 appearance on the PBD Podcast, Schiff conceded that a portfolio heavily weighted toward the so-called “Magnificent Seven” — Apple, Microsoft, Amazon, Alphabet, Nvidia, Tesla and Meta — would have multiplied his wealth far beyond what his gold-centered strategy delivered.

“Had I had all my money 10 years ago in the Magnificent Seven, I’d be a lot richer than I am today,” Schiff said. “I mean, I’m rich enough, but I would have more money had I concentrated on those names.”

Tech Investors Saw Explosive Gains

His admission comes as new Federal Reserve data shows the net worth of the top 1 percent in the U.S. surged to $51.9 trillion in Q2 2025, driven in large part by booming equity valuations. Schiff, who has publicly stated his net worth exceeds $80 million, fits within that bracket but acknowledges that his returns lag those of investors who embraced dominant tech stocks throughout the 2010s and early 2020s.

The Magnificent Seven alone have dramatically outpaced the S&P 500 over the last decade, delivering historic gains and reshaping market concentration at the index’s upper end.

Schiff Still Warns Against Overreliance on Stocks

Despite his hindsight regret, Schiff maintains that U.S. stock valuations are inflated and distorted by more than a decade of accommodative monetary policy. He argues that much of the wealth generated by equities is “artificial,” propped up by low interest rates and aggressive Federal Reserve interventions, especially during the COVID-19 pandemic.

Investors, he says, are “benefiting from the inflated asset price level” rather than from sustainable economic fundamentals.

Why Schiff Still Backs Gold

Schiff also reiterated his long-held view that the U.S. dollar faces long-term erosion, predicting accelerating “de-dollarization” as more countries diversify away from the greenback. He pointed to record-high central bank gold purchases, more than 1,030 tonnes in 2023 according to the World Gold Council, as evidence of a global shift toward hard assets.

“Gold has already broken out,” he said, arguing that the metal remains a critical hedge in an increasingly fragile economic system.

Balancing a Modern Portfolio

Schiff’s comments highlight the tension facing many investors: the massive gains generated by dominant tech stocks versus the perceived long-term security of gold. While he acknowledges missing out on extraordinary equity returns, he continues to caution that being overweight U.S. tech could leave investors exposed if market valuations correct sharply.