Secured Loans Are Less Costly Than Unsecured Loans Because

Secured Loans Are Less Costly Than Unsecured Loans Because

Secured Loans Are Less Costly Than Unsecured Loans Because whenever we have to take anything at present time we think off loans. This is majorly because they are easy to take and also in terms of repayment.

Mainly they are taken because at present time most of the people do not have sufficient money to pay back the amount in one go.

However, the case where there are different types of loans that can be taken too. Now here we have come up with secured loans are less costly than unsecured loans.

But what makes them easy? Let us help you to find the one answer.

Also read – Avoid Mishap This Holiday and Decoratewith Your Cat in Mind

About secured loans?

It has been found that secured loans are less costly that an unsecured and the major reason is their risk ability.

But there are many other reasons too.

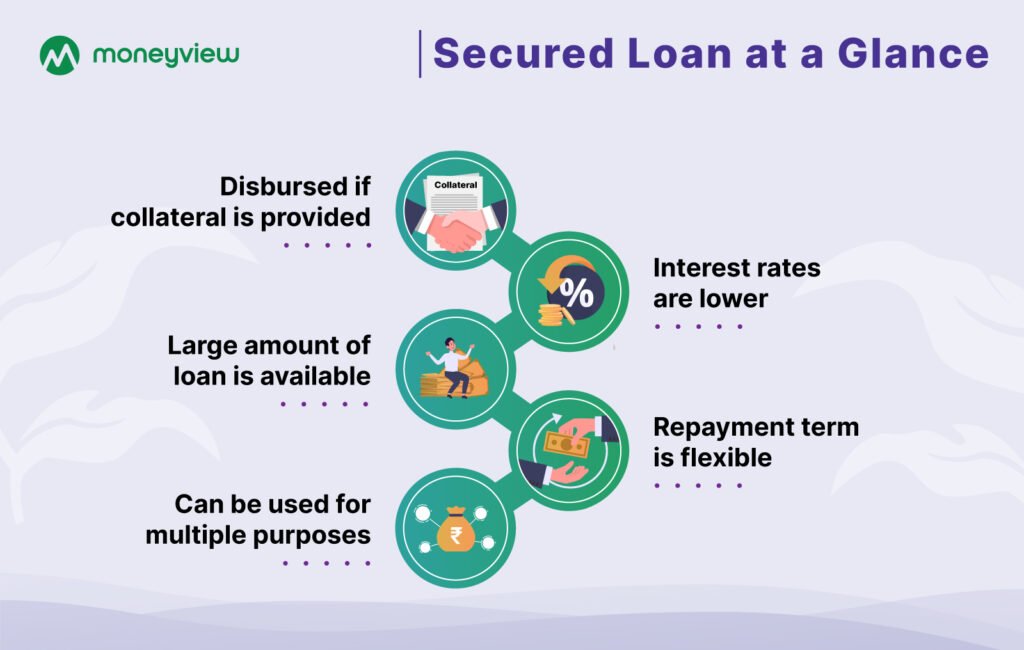

When we talk about the secured loans here the borrower pledge the assets as the collateral. This can be a house or a car and this indicates if a borrower defaults here then the lender can seize the collateral.

This is mainly done to cover up the losses. Here in turn this helps to reduce the risk of the lender.

It is mainly because the amount can be repaid back.

Comes with lower interest rate and this is one of the main reason to consider them too. In this case the lenders are more prone to offer loan because of the low interest rate.

Here borrowers can easily save money on the interest payment – this is mainly towards the life of the span.

Also here the interest rate will also vary depending upon the lender.

In other case it has been looked that there are more flexible loan term. Here lenders will be more willing to have the security to fall back if the borrower fails.

Types of secured loans

There are different types of secured loans that are considered to be delivered or taken by borrowers.

Hence, here we will mention you will all of those.

Home loans

Home loans are determined to be the type of secured loans. They are given to the customers to buy a new home and with tons of benefits.

However, when it comes to repayment then house itself work as the collateral. It means if in case borrowers are unable to repay back the money then house can be taken.

Auto loan

If you are willing to buy a new car then secured loans comes into play. They are quite easy to taken and holds the less repayment tenure and interest rate.

This way borrowers get the flexibility to hold on command and to buy the car as per their wish.

Personal loan

A personal loan can be used as both secured and unsecured loan type. In case if it is secured then borrowers can easily pledge a valuable assets. This can be a car which serves to be collateral.

Business loan

Next in the category is the business loan and this can be too secured and also unsecured. If it is considered to be unsecured then business can be considered as the collateral.

This can involve any inventory and also equipment’s too.

There are many such type of loans you can find and the secured one. however, it is all dependant upon you what are your requirements and how you want to get them.

Also it is advisable for you to read all of the necessary documents before adopting the one. this will help you to be away from any sort of disadvantage that can restrict you ahead.

Also read – What Is A Ponzi Scam?

Frequently asked questions

What are secured loans?

A secured loan is the type of loans that borrower pledge as the collateral. This can be for anything like for car, house or even for business.

What are the different types of secured loans?

There are different types of secured loan like for business, if you want to take car, or also house.