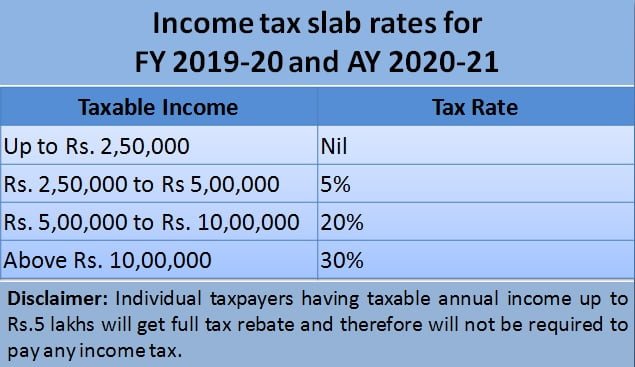

Income Tax Slab for A.Y. 2020-21 Pdf Download

it slab

The interim Finance Minister Piyush Goyal presented the 2019 Interim Budget on 1 February 2019. This interim budget is determined by the populist moves mainly.

A discount of Rs.12500 has been announced for taxpayers who have an assessable or taxable income of up to Rs.5 lakh.

Income Tax Slab and Rates for A.Y. 2020-21 and F.Y. 2019-20 Pdf Download

One can visit the official website of Income-tax to income tax slab for A.Y. 2020-21 Pdf download. Under this slab, there are 3 distinct groupings of individual taxpayers and 1 for domestic entities. The groupings are mentioned below:

- Individuals and Hindu Undivided Family (HUF) below 60 years old

- Senior Citizens who are 60 years old or more, but below 80 years old

- Senior Citizens who are 80 years old or above

- Domestic Companies or Corporations

Sorts of Income Tax Slabs for A.Y. 2020-21 Pdf Download

Based on the individual’s age, several tax slabs are projected by the government. Three different types of individual taxpayers are listed below:

- Individuals who are less than the age of 60 years. It can embrace individuals who are residents as well as non-residents.

- Senior citizens who are more than the age of 60 years and less than the age of 80 years and are resident Indians.

- Super senior citizens who are over the age of 80 years old and are resident Indians.

Main Parts of the Interim Budget 2019 concerning Income Tax Slabs

The main parts of the interim budget 2019 about the income tax slabs can be illustrated as below:

- Individuals who get a salary of up to Rs.5 lakh will not be required to pay any income tax.

- The tax slabs for the F.Y. 2019-20 remain unaltered.

- Rs.23000 crore is to be granted by direct tax proposals. It is meant to offer tax relief to about 3 crore taxpayers.

- Individuals who draw a gross salary of up to Rs.6.5 lakh will be able to gain full tax exemption if they make investments in insurance, provident funds, and other specified savings schemes.

- The standard deduction has been enhanced to the extent of Rs.50000 now, as opposed to the formerly prevailing amount of Rs.40000.

Income tax slabs for the financial year 2019-20 apply to those who earn above Rs.2.5 lakh annually. The rate at which individuals are levied depends on the level of income they earn, with rates rated at nil, 5%, 20%, and 30%. For more details, you can download Income Tax Slabs for A.Y. 2020-21 in Pdf file.

Related Topic – Coronavirus: Information Regarding Covid-19- Symptoms, Prevention & Medical Treatments

Nurul Hidayah Video ZIP: Viral TikToker Showed Undignified Acts – Video Viral Nurul Hidayah